LOS ANGELES – The former top administrator in the City of Bell, who has admitted his role in a widespread municipal corruption scandal, was sentenced today to two years and nine months in federal prison for tax fraud.

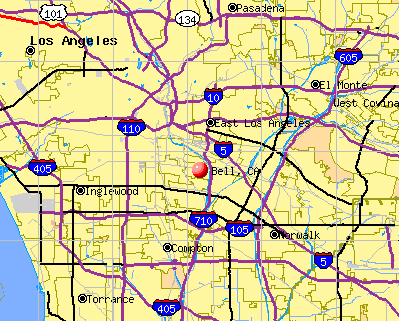

Robert A. Rizzo’s tax fraud was concocted to hide part of the massive income he was bilking from the small Los Angeles County city of Bell, which has a population of 35,000 residents, according to authorities.

U.S. District Court Judge George H. King said 60-year-old defendant Rizzo’s activities demonstrated “greed in cheating the taxpayers of the United States after cheating the citizens of Bell.”

Rizzo will be sentenced Wednesday for his corruption conviction in Los Angeles Superior Court.

Rizzo is facing 10 to 12 years in prison in state court on charges relating to corruption.

Once the highest paid municipal administrator in California, and likely the nation, Rizzo became the face  of the widespread corruption in Bell, doling out city funds to colleagues and business interests, falsifying public records and misappropriating public funds, according to the Los Angeles Times.

of the widespread corruption in Bell, doling out city funds to colleagues and business interests, falsifying public records and misappropriating public funds, according to the Los Angeles Times.

When he was forced to resign in 2010, the Los Angeles Times reported Rizzo had a total compensation package of roughly $1.5 million and was on track to become the highest paid public pensioner when he retired.

Judge King ordered that the Torrance resident’s federal prison sentence run consecutive to the state’s sentence, which means he will have to serve one prison sentence before he can begin serving a second prison term

Rizzo is expected to receive Wednesday when he is sentenced in Los Angeles Superior Court in his corruption case.

Rizzo pleaded guilty in January to federal charges – conspiracy and filing a false federal income tax return with the Internal Revenue Service – in a scheme that resulted in hundreds of thousands of dollars in unpaid federal income tax.

In addition to the federal prison sentence, Judge King ordered Rizzo to pay $255,984 in restitution, a figure that equals the amount of unpaid taxes Rizzo owes.

In his plea agreement, Rizzo admitted that he created a corporation to fraudulently claim losses on his income tax return, which served to illegally reduce his tax liability on the significant income he was receiving from the City of Bell.

Rizzo also admitted claiming personal expenses as business deductions.

In a sentencing memo, prosecutors wrote: Rizzo’s “conduct can only be described as corrupt.

Not only did Rizzo fleece the City of Bell and its residents, he also bilked the Internal Revenue Service “in an extraordinary display of greed,” prosecutors stated.

According to court documents, some time in 2002 Rizzo created a corporation that he called R.A. Rizzo Incorporated.

Rizzo was assisted in the scheme by co-conspirators that included his tax preparer, Robert J. Melcher, who has pleaded guilty to aiding and abetting the filing of a false tax return, according to authorities.

Rizzo used R.A. Rizzo to claim bogus losses in relation to a purported rental property in Auburn, Washington. Rizzo’s corporate tax return fraudulently deducted more than $571,530 in losses for the years 2006 through 2009, officials said.

Rizzo also admitted in his plea agreement that he used a R.A. Rizzo account to pay for more than $80,000 in personal expenses in 2009 and $120,000 in construction work on his residence in Huntington Beach in 2010.

The corporation’s tax returns falsely claimed that these expenses were related to rental property.

Rizzo “abused his position to fleece the City of Bell of hundreds of thousands of dollars that he paid to himself in excessive salary – monies that could have been spent for the benefit of the people he served,” according to the government’s sentencing memo.

“But not satisfied with betraying the trust placed in him by the city and its residents, in an extraordinary display of greed, [Rizzo] also found it necessary to cheat the IRS,” the memo stated.

Melcher, who as a result of his guilty plea faces a sentence of up to three years in prison, is scheduled to be sentenced in May.