FORECLOSING ON A 90-YEAR-OLD WOMAN OVER 27 CENTS AND OTHER HEARTWARMING TALES FROM STEVEN MNUCHIN’S DAYS AT ONEWEST

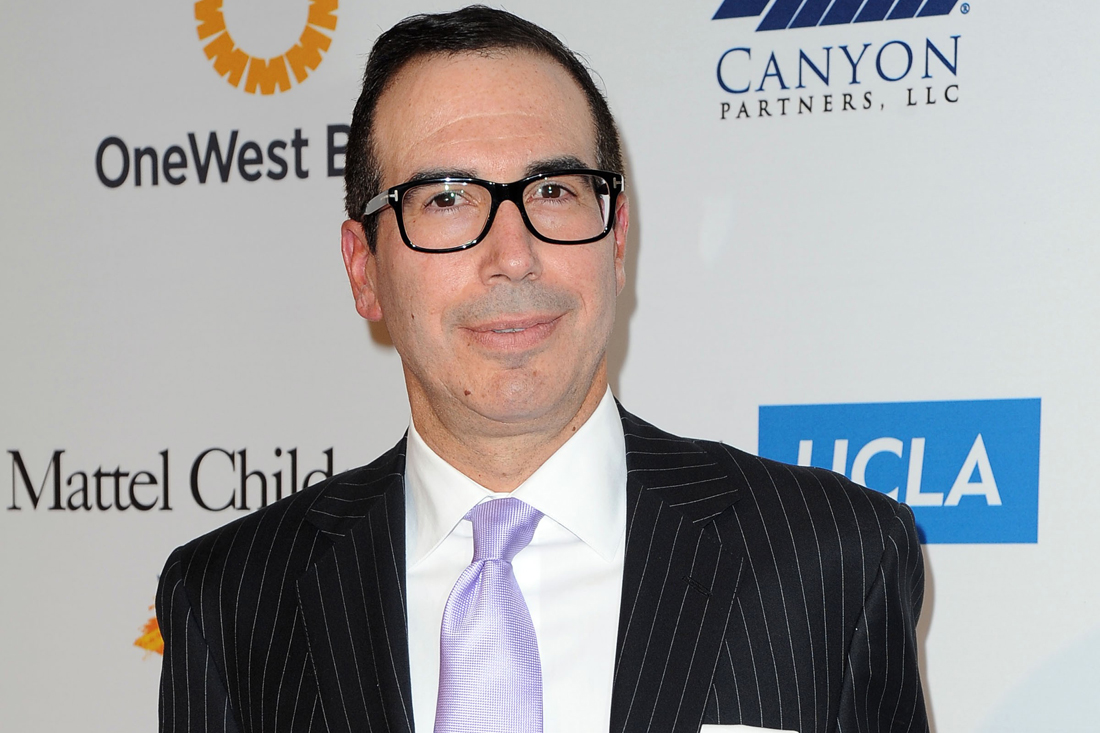

Since it was announced Tuesday evening that Donald Trump will nominate Steven Mnuchin for Treasury secretary, a lot of time has been spent focusing on the 17 years Mnuchin worked at Goldman Sachs and whether it should disqualify him for the job.

And while some might argue that having Goldman Sachs on your résumé helps qualify a person for this sort of position, the fact that the president-elect spent much of his campaign telling Americans not to vote for Hillary Clinton, in part, because she is “owned” by the bank (not to mention running an ad demonizing C.E.O. Lloyd Blankfein as part of a sinister “global power structure”) makes his decision to give multiple people from the firm—including, maybe, its No. 2 employee—top positions in his administration somewhat hypocritical.

Of course, focusing on Goldman Sachs obscures the far more terrible achievements of Mnuchin’s own career, like producing Suicide Squad. There was also the time he literallyforced people out of their homes while he was running OneWest, the lender he sold last year for a personal gain of several millions of dollars. As Bloomberg previously reported, OneWest “carried out more than 36,000 foreclosures during Mnuchin’s reign,” earning the bank a reputation as a “foreclosure machine.” Here, some highlights of Mnuchin’s company’s work:

- Changing the locks on Leslie Parks’s Minneapolis house, during a blizzard.

- Allegedly refusing to negotiate with Greg Horoski and his wife, Diane Yano-Horoski, when the couple fell behind on payments due to Horoski getting sick; treating them, in the words of Judge Jeffrey Spinner, to “mortifying abuse”; and generally acting in a manner that was not only “inequitable, unconscionable, vexatious and opprobrious” but also “harsh, repugnant, shocking and repulsive.” (OneWest commented at the time, “We respectfully disagree with the lower court’s unprecedented ruling,” which wiped out the $525,000 the couple owed in mortgage payments. It also claimed it had been “extremely active in working with consumers on home loan modifications through the Obama administration’s Home Affordable Modification Program and other loan modification initiatives.”)

- Allegedly sending a homeowner’s name to a debt collector who proceeded to “call her 81 times in a single day.”

- And the pièce de résistance: reportedly foreclosing on a 90-year-old woman, Ossie Lofton, who owed the bank 30 cents but sent a check for 3 cents.

By comparison, Mnuchin’s time at Goldman was akin to working as a volunteer in Ethiopia, feeding and bathing orphans, and walking multiple miles for clean water in his personal time. If only he’d stuck to being a pawn of the “global power structure,” we might all be a little better off.