LOS ANGELES

The owner of The Skin Cancer Medical Center in Encino has paid the federal government nearly $2.7 million to resolve allegations that he submitted bills to Medicare for Mohs micrographic surgeries for skin cancers that were medically unnecessary, according to officials.

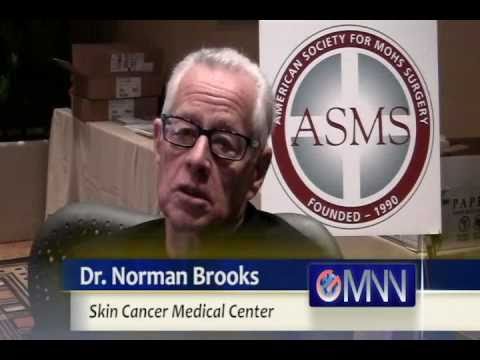

Dr. Norman A. Brooks, M.D., a dermatologist and surgeon, paid the $2,681,400 settlement on April 10.

The settlement, which was finalized on March 31, resolved allegations in a lawsuit brought by a former employee of The Skin Cancer Medical Center.

The settlement was announced today when prosecutors learned that United States District Judge Philip S. Gutierrez had unsealed and dismissed the complaint that was filed under the False Claims Act.

The lawsuit alleged that Brooks falsely diagnosed skin cancer in some of his patients so that he could perform, and bill for, Mohs surgeries.

Mohs surgery is a specialized surgical procedure for removing certain types of skin cancers in specific areas of the body, including the face. The surgery is performed in stages during which the surgeon removes a single layer of tissue which undergoes a microscopic evaluation. The surgeon performs additional stages, if

The surgery is performed in stages during which the surgeon removes a single layer of tissue which undergoes a microscopic evaluation. The surgeon performs additional stages, if necessary, until all of the cancer is removed.

Given the complexity and time required to perform the procedure, Mohs yields a higher Medicare reimbursement than other procedures used to remove skin lesions.

As part of the settlement, Brooks entered into a three-year Integrity Agreement with the U.S. Department of Health and Human Services, Office of Inspector General.

Under the Integrity Agreement, Brooks will establish and maintain a compliance program that includes, among other things, mandated training for Brooks and his employees and review procedures for claims submitted to Medicare and Medicaid programs.

Under the Integrity Agreement, Brooks will set up a compliance program that includes, among other things, mandated training for Brooks and his employees and review procedures for claims submitted to Medicare and Medicaid programs.

Under the Integrity Agreement, Brooks will set up a compliance program that includes, among other things, mandated training for Brooks and his employees and review procedures for claims submitted to Medicare and Medicaid programs.

The settlement resolves allegations made in a lawsuit filed by former Brooks employee Janet Burke under the qui tam, or “whistleblower,” provisions of the False Claims Act, which permit private parties to sue on behalf of the government and receive a share of any recovery.

For her role in the case, Burke will receive $482,652.

In settling the case, Brooks did not admit liability in the matter.