What to look for when choosing a policy

By Barbara Kiviat

(Published April 2017)

With college graduation season here, scads of young adults will soon rent their first apartments and possibly buy their first renter’s insurance policy.

There’s little reason not to get it: The average policy costs just $190 per year, according to the National Association of Insurance Commissioners. For the price of a few lattes a month, renters can cover their possessions, the cost of accommodations elsewhere if their home becomes uninhabitable, and liability for accidents on the premises. They just need to consider what kind of policy is best.

There’s little reason not to get it: The average policy costs just $190 per year, according to the National Association of Insurance Commissioners. For the price of a few lattes a month, renters can cover their possessions, the cost of accommodations elsewhere if their home becomes uninhabitable, and liability for accidents on the premises. They just need to consider what kind of policy is best.

“The biggest problem with renters insurance is that a lot of people don’t have it,” says Rebecca Korach Woan, CEO of Chartwell Insurance Services in Chicago.

About 95 percent of homeowners have policies to cover theft, fire, and other home hazards, but only 41 percent of renters carry equivalent coverage, according to the Insurance Information Institute.

To help you find the best policy whether you’re a first-time renter, a longtime tenant, or a downsizing homeowner entering the rental market, consider these suggestions.

Understand what the policy covers. When you have a renters policy, an insurer typically pays for damage to your personal property, the cost of staying elsewhere if your place is inhabitable (say, from smoke damage), and accidents for which you might be legally liable—for example, if a visitor gets hurt or has property damaged at your place and files a lawsuit.

Understand what the policy covers. When you have a renters policy, an insurer typically pays for damage to your personal property, the cost of staying elsewhere if your place is inhabitable (say, from smoke damage), and accidents for which you might be legally liable—for example, if a visitor gets hurt or has property damaged at your place and files a lawsuit.

Make sure any policy you buy covers all three.

Take a close look at which “perils” are covered. Policies generally cover losses from a long list of unfortunate events including fire, theft, vandalism, smoke, hail, explosions, and riots. But some perils—notably earthquakes and floods—generally aren’t covered. If you’re at risk for these, you’ll need separate insurance.

Realize, too, that renters insurance won’t help much when losses are business-related, says Chris Boggs, executive director of Big I Virtual University, an education arm of the Independent Insurance Agents and Brokers of America. If you have a lot of work-related items at home or people visiting for business, you may want additional insurance.

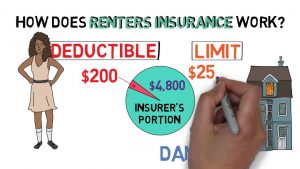

Pick coverage limits that make sense for you. To get a sense of how much personal property coverage you need, Lynne Chesley, a broker at NRG Insurance in Seattle, suggests asking yourself, “How much is it going to cost to replace everything in my house right now, brand new?” People are often surprised by the value of what they own once they add it all up.

Policies cover either the replacement cost of the property or its actual value. The latter takes into account that older items may have lost value over time. You might save on your premium by opting for actual value coverage, but it’s usually well worth the price to go with a policy that covers replacement cost because that’s what you’ll have to pay to buy new things.

Policies cover either the replacement cost of the property or its actual value. The latter takes into account that older items may have lost value over time. You might save on your premium by opting for actual value coverage, but it’s usually well worth the price to go with a policy that covers replacement cost because that’s what you’ll have to pay to buy new things.

Most policies limit how much insurers shell out for certain items (often valuable), such as jewelry, watches, furs, silverware, collectibles, firearms, and cash. It’s possible to add more coverage for these items, and it’s often smart to do so, but you’ll have to get that added to the policy—and pay more.

On the liability side (if someone gets hurt while visiting you and sues for damages), Chesley recommends buying at least $300,000 in coverage, even though many landlords require tenants to insure for only $100,000. The differences in price, she says, might be no more than $10 per year, and if something bad happens, you’ll be glad to have the higher limit.

Consider a policy with a high deductible. You can also specify how high you want your deductible to be; that is, how much you pay out of pocket before insurance kicks in. A $500 deductible is typical, but Woan suggests bumping it up to $1,000. “At any stage in your life,” she says, “take the highest deductible you can afford.”

By doing this, you’ll discourage yourself from filing small claims, because filing a lot of claims can increase the price you pay for insurance later. This can be particularly important if the next property insurance you buy is a homeowners policy. Since such policies are costlier, lower rates will translate into more savings.

Look for discounts. The price you pay for renters insurance largely depends on where you live, the age and construction of your building, your proximity to a fire department, and other factors that existed when you chose to rent a particular apartment or house.

That said, there are few ways you might lower your rates after the fact. One is to make safety improvements, like installing a deadbolt lock or having a fire extinguisher and telling your insurer about it. You might also get a small discount, along with the lines of 10 percent, for “bundling,” or buy your renters policy from the same company as, say, your car insurance.

One way you may be tempted to save money is by splitting the cost of a policy with a roommate. But for the difference in how much you’ll pay—perhaps $100 or so—Boggs’s says that’s usually not a good idea. You don’t want claims your roommate files increasing the premium you pay. And if you change roommates, you’ll have to redo the policy.