The Justice Department announced Wednesday that Rite Aid Corporation and its subsidiaries, Elixir Insurance Company, RX Options LLC, and RX Solutions LLC, agreed to settle allegations of violating the False Claims Act (FCA) by inaccurately reporting drug rebates to the Medicare Program.

The Justice Department announced Wednesday that Rite Aid Corporation and its subsidiaries, Elixir Insurance Company, RX Options LLC, and RX Solutions LLC, agreed to settle allegations of violating the False Claims Act (FCA) by inaccurately reporting drug rebates to the Medicare Program.

Elixir Insurance and Rite Aid will pay $101 million to the United States as part of the settlement.

Additionally, RX Options and RX Solutions will grant the federal government a $20 million general unsecured claim in Rite Aid’s ongoing bankruptcy case in the District of New Jersey.

The settlement is based on the companies’ ability to pay and was approved on June 28 by the bankruptcy court as part of Rite Aid’s plan of reorganization, which is expected to become effective later this summer.

(News Report 2023)

In addition to operating one of the country’s largest retail pharmacy chains, Rite Aid offered Medicare drug plans and pharmacy benefits manager (PBM) services through Elixir Insurance, RX Options and RX Solutions.

“Rite Aid and its Elixir subsidiaries lined their corporate pockets with millions of dollars of manufacturer rebates that should have been reported to Medicare,” said U.S. Attorney Rebecca C. Lutzko for the Northern District of Ohio. “Each of those dollars could have been used to benefit Americans with genuine health care needs. Our office will not tolerate deceptive health-insurance practices, and we will vigorously pursue those who violate the FCA.”

“Rite Aid and its Elixir subsidiaries lined their corporate pockets with millions of dollars of manufacturer rebates that should have been reported to Medicare,” said U.S. Attorney Rebecca C. Lutzko for the Northern District of Ohio. “Each of those dollars could have been used to benefit Americans with genuine health care needs. Our office will not tolerate deceptive health-insurance practices, and we will vigorously pursue those who violate the FCA.”

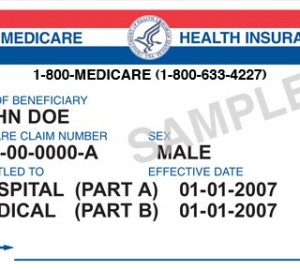

Under Medicare Part D, private entities known as Plan Sponsors offer and manage insurance plans that cover prescription drugs for enrolled Medicare beneficiaries.

Each year, these Plan Sponsors must report to the Centers for Medicare and Medicaid Services (CMS) about any rebates or other payments they received from drug manufacturers for Part D drugs.

This reporting ensures that the government benefits from any price discounts given by drug manufacturers. CMS uses these reports in an annual process to determine the final payments due to the Plans or to CMS at the year’s end.

The settlement resolves allegations that, between 2014 and 2020, the defendants improperly reported to CMS portions of rebates received from manufacturers as bona fide service fees, even though manufacturers did not negotiate with the defendants to pay such fees.

The federal government further alleged that Elixir Insurance knew the retained rebates did not meet the regulatory definition of bona fide services fees.

The civil settlement includes the resolution of claims brought in 2021 under the qui tam, or whistleblower, provisions of the False Claims Act by Glenn Rzeszutko, who previously worked for RX Options.

The FCA authorizes a private party to sue on behalf of the United States and share in any recovery. The relator’s share of these proceeds has not yet been determined.